If you’re tired of juggling bonus categories or missing out on rewards due to complex programs, the Chase Freedom Unlimited Credit Card offers a welcome breath of fresh air. With 1.5% cash back on every purchase, plus elevated rates—5% on travel through Chase Travel℠, 3% on dining (including takeout and delivery), and 3% at drugstores—it’s a card that rewards your spending without added effort.

Add in a $200 bonus for hitting a $500 spend in your first three months, 15 months of 0% APR on purchases and balance transfers, and no annual fee, and you’ve got a top-tier everyday card.

Simplicity Counts—Here’s Why Chase Stays Ahead

Where many cards insist you play a spending game—enrolling in quarterly categories or shifting to new tiers—Chase Freedom Unlimited just gives you value right out of the gate. Compared to cards like the rotating-category Freedom Flex or flat-rate Quicksilver, this card combines automatic earnings, promotional APR, and strong ongoing perks.

If you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Preferred card, you can unlock even higher redemption values for your rewards by transferring to Chase’s travel partners.

Different Card Types—Where This One Fits

Here’s how the Chase Freedom Unlimited compares to common credit card types:

| Card Type | Best For |

| Flat-rate cash back | Simple, consistent rewards on everything you spend |

| Rotating-category cash back | Bonus rates in changing categories, with required activation |

| Travel rewards | Building points for flights, hotels, and elite perks |

| Balance transfer-focused | Moving debt to an interest-free window |

| Premium travel | Luxury services with higher annual fees |

The Chase Freedom Unlimited bridges flat-rate simplicity and balance transfer utility — delivering flexibility for both spending and financial management.

Why This Card Excels: Core Features

- 1.5% Cash Back on All Purchases – No caps, no activation, just consistent rewards.

- Bonus Categories – 5% on Chase Travel℠, 3% on dining and drugstores.

- $200 Bonus – After spending $500 in the first three months.

- 0% Intro APR – Enjoy 15 months on both purchases and balance transfers.

- No Annual Fee – Keeps your rewards 100% profitable.

- Ultimate Rewards Flexibility – Redeem for cash, gift cards, or transfer to valuable travel partners.

- Built-in Protections – Includes purchase protection, trip cancellation insurance, and rental car coverage.

A Real Opportunity for Credit and Savings

Because Chase reports to all major credit bureaus, using the card responsibly—by paying on time and keeping balances low—can boost your credit score. Plus, the 15-month 0% APR timeframe is ideal for reducing revolving balances or covering large purchases while preserving your budget.

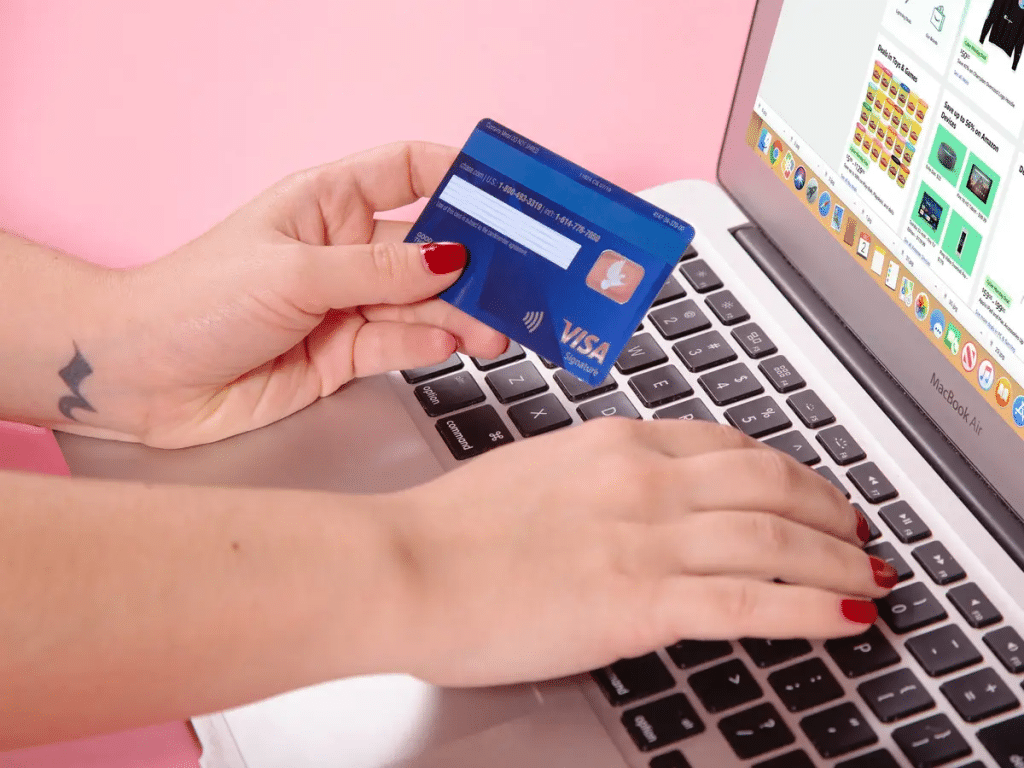

Steps to Apply for Chase Freedom Unlimited

- Go to Chase’s official website and find the Freedom Unlimited card.

- Hit Apply Now and fill out your personal and financial info.

- Most applicants receive an instant decision.

- Upon approval, your card arrives in the mail. Use it and enjoy the introductory APR and bonus.

Ideal User Profile

This card is a strong fit for:

- Everyday spenders who value automatic rewards

- People looking to consolidate debt at a low or zero interest rate

- Anyone wanting a no-annual-fee card with bonus earning potential

- Shoppers who prefer flexible redemption options

- Chase banking customers building toward premium travel perks

Just note: foreign transactions carry a fee, so it’s not ideal for frequent overseas use.

Conclusion: Why Freedom Unlimited Delivers Long-Term Value

With its seamless earning, rotating bonus categories, extended intro APR, and no annual fee, the Chase Freedom Unlimited is one of the most accessible—and rewarding—credit cards available.

Apply today and start earning on every purchase, your way.

Chase Ink Business Credit Card <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Discover why the Chase Ink Business Credit Card is a top choice for U.S. small business owners, offering strong cash back rewards, flexible benefits, and business-focused financial tools.</p>

Chase Ink Business Credit Card <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Discover why the Chase Ink Business Credit Card is a top choice for U.S. small business owners, offering strong cash back rewards, flexible benefits, and business-focused financial tools.</p>